Forex elementary analysis is a cornerstone of thriving trading, featuring important insights in the forces driving forex values. It entails assessing financial indicators, political events, and industry sentiment to forecast future price tag actions. This guideline aims to provide a thorough knowledge of forex elementary Assessment, encouraging traders make educated conclusions and enrich their buying and selling approaches.

Precisely what is Forex Elementary Examination?

Forex elementary Investigation consists of inspecting macroeconomic indicators, including GDP, fascination costs, and inflation, to find out the intrinsic price of a forex. Compared with technological Assessment, which concentrates on price tag designs, basic Evaluation assesses the broader financial natural environment to forecast currency actions.

Critical Economic Indicators in Forex Fundamental Assessment

Understanding essential economic indicators is essential for effective forex elementary Investigation. These indicators give insights into a country's financial overall health and influence currency values.

1. Gross Domestic Item (GDP): GDP steps a country's financial output and development. A mounting GDP suggests a healthful economic climate, generally resulting in a stronger forex.

2. Desire Charges: Central banking institutions manipulate fascination prices to manage inflation and stabilize the economy. Increased interest premiums usually catch the attention of foreign financial investment, boosting the forex value.

3. Inflation Fees: Inflation actions the speed at which costs for products and solutions rise. Reasonable inflation is regular, but abnormal inflation can erode a forex's obtaining power.

Central Banking institutions and Monetary Policy

Central banking institutions Perform a pivotal position in forex essential analysis. They set curiosity costs and carry out monetary procedures to control economic security.

one. Desire Rate Selections: Central banking companies modify interest rates to regulate inflation and encourage or awesome down the economic system. Traders look at these choices carefully because they could potentially cause major forex fluctuations.

two. Quantitative Easing: This coverage entails acquiring authorities securities to raise the cash provide. It aims to lessen fascination fees and encourage financial growth, typically weakening the currency.

Political and Geopolitical Functions

Political steadiness and geopolitical occasions substantially affect currency values. Elections, policy alterations, and Global conflicts might cause market volatility.

one. Elections: Election outcomes can result in policy adjustments affecting financial development and stability. Market sentiment often shifts dependant on the perceived economic impact of The brand new administration.

two. Geopolitical Tensions: Conflicts and tensions involving international locations can disrupt trade and financial balance, Forex Fundamental Analysis bringing about currency depreciation.

Trade Balances and Present-day Accounts

Trade balances and existing accounts replicate a country's economic transactions with the remainder of the planet. They offer insights in to the desire for a rustic's currency.

1. Trade Stability: The trade harmony steps the distinction between a rustic's exports and imports. A optimistic trade harmony (surplus) implies much more exports than imports, strengthening the currency.

2. Recent Account: This accounts for all Intercontinental transactions, including trade, expenditure profits, and transfers. A surplus implies a Web inflow of international currency, boosting the currency's benefit.

Market Sentiment and Speculation

Marketplace sentiment, pushed by buyers' perceptions and speculations, can cause short-time period currency fluctuations. Comprehending market place psychology is important for forex basic Assessment.

one. Trader Self confidence: Positive financial information can boost investor self confidence, resulting in amplified demand for your forex. Conversely, adverse information can cause forex offer-offs.

two. Speculative Trading: Traders generally speculate on foreseeable future financial gatherings, driving forex costs based on their anticipations. These speculative moves might cause quick-time period volatility and produce buying and selling possibilities.

Applying Forex Fundamental Assessment in Trading

To use forex elementary Investigation proficiently, traders must stay educated about economic activities and information releases. This is a move-by-move tactic:

one. Remain Current: On a regular basis observe economic information, central lender bulletins, and geopolitical developments. Economic calendars are valuable tools for monitoring important events.

two. Analyse Details: Appraise how economic indicators and gatherings align together with your investing approach. Think about the potential effect on forex values and market place sentiment.

3. Acquire a method: Use essential Examination to build a investing method that accounts for financial tendencies and possible market shifts. Merge it with complex Evaluation for a holistic tactic.

four. Chance Administration: Fundamental Investigation might help establish prospective threats and chances. Apply hazard management tactics to shield your investments and maximise returns.

Common Inquiries and Problems

How exact is forex fundamental Evaluation?

Fundamental Examination is not really foolproof but provides useful insights into market place developments. Combining it with specialized Evaluation can boost accuracy.

Can newcomers use elementary Investigation?

Certainly! Inexperienced persons can get started by being familiar with key economic indicators as well as their effect on currency values. Over time, they can develop much more sophisticated procedures.

How frequently must I carry out fundamental Investigation?

Standard Evaluation is important for productive buying and selling. Remain updated on financial activities and periodically assessment your strategy dependant on new knowledge and market disorders.

Conclusion

Forex fundamental Examination is A necessary Instrument for traders seeking to be familiar with and anticipate market actions. By analysing economic indicators, central financial institution insurance policies, political activities, and current market sentiment, traders could make educated decisions and build strong trading approaches. Stay informed, continuously refine your approach, and Merge essential analysis with other strategies to accomplish investing achievements.

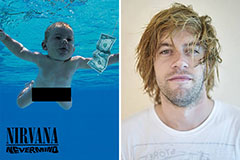

Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now!